As enterprise startups continue to target interesting gaps in the market, we’re seeing increasingly sophisticated tools getting built for small and medium businesses — traditionally a tricky segment to sell to, too small for large enterprise tools, and too advanced in their needs for consumer products. In the latest development of that trend, an Israeli startup called DataRails has raised $25 million to continue building out a platform that lets SMBs using Excel to run financial planning and analytics like their larger counterparts.

The funding closes out the company’s Series A at $43.5 million, after the company initially raised $18.5 million in April (some at the time reported this as its Series A, but it seems the round had yet to be completed). The full round includes Zeev Ventures, Vertex Ventures Israel, and Innovation Endeavors, with Vintage Investment Partners added in this most recent tranche. DataRails is not disclosing its valuation, except to note that it has doubled in the last four months, with hundreds of customers and on target to cross 1,000 this year, with a focus on the North American market. It has raised $55 million in total.

The challenge that DataRails has identified is that on one hand, SMBs have started to adopt a lot more apps, including software delivered as a service, to help them manage their businesses — a trend that has been accelerated in the last year with the pandemic and the knock-on effect that has had for remote working and bringing more virtual elements to replace face-to-face interactions. Those apps can include Salesforce, NetSuite, Sage, SAP, QuickBooks, Zuora, Xero, ADP and more.

But on the other hand, those in the business who manage its finances and financial reporting are lacking the tools to look at the data from these different apps in a holistic way. While Excel is a default application for many of them, they are simply reading lots of individual spreadsheets rather than integrated data analytics based on the numbers.

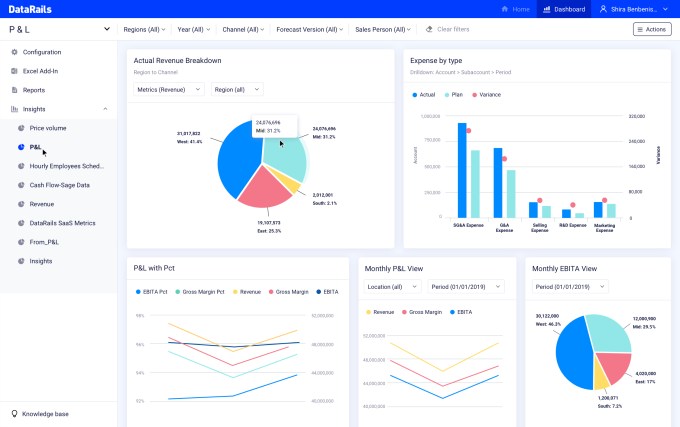

DataRails has built a platform that can read the reported information, which typically already lives in Excel spreadsheets, and automatically translate it into a bigger picture view of the company.

For SMEs, Excel is such a central piece of software, yet such a pain point for its lack of extensibility and function, that this predicament was actually the germination of starting DataRails in the first place,

Didi Gurfinkel, the CEO who co-founded the company with Eyal Cohen (the CPO) said that DataRails’ initially set out to create a more general purpose product that could help analyze and visualize anything from Excel.

“We started the company with a vision to save the world from Excel spreadsheets,” he said, by taking them and helping to connect the data contained within them to a structured database. “The core of our technology knows how to take unstructured data and map that to a central database.” Before 2020, DataRails (which was founded in 2015) applied this to a variety of areas with a focus on banks, insurance companies, compliance and data integrity.

Over time, it could see a very specific application emerging, specifically for SMEs: providing a platform for FP&A (financial planning and analytics), which didn’t really have a solution to address it at the time. “So we enabled that to beat the market.”

“They’re already investing so much time and money in their software, but they still don’t have analytics and insight,” said Gurfinkel.

That turned out to be fortunate timing, since “digital transformation” and getting more out of one’s data was really starting to get traction in the world of business, specifically in the world of SMEs, and CFOs and other people who oversaw finances were already looking for something like this.

The typical DataRails customer might be as small as a business of 50 people, or as big as 1,000 employees, a size of business that is too small for enterprise solutions, “which can cost tens of thousands of dollars to implement and use,” added Cohen, among other challenges. But as with so many of the apps that are being built today to address those using Excel, the idea with DataRails is low-code or even more specifically no-code, which means “no IT in the loop,” he said.

“That’s why we are so successful,” he said. “We are crossing the barrier and making our solution easy to use.”

The company doesn’t have a huge number of competitors today, either, although companies like Cube (which also recently raised some money) are among them. And others like Stripe, while currently not focussing on FP&A, have most definitely been expanding the tools that it is providing to businesses as part of their bigger play to manage payments and subsequently other processes related to financial activity, so perhaps it, or others like it, might at some point become competitors in this space as well.

In the meantime, Gurfinkel said that other areas that DataRails is likely to expand to cover alongside FP&A are likely to include HR, inventory, and “planning for anything,” any process that you have running in Excel. Another interesting turn would be how and if DataRails decides to look beyond Excel at other spreadsheets, or bypass spreadsheets altogether.

The scope of the opportunity — in the U.S. alone there are more than 30 million small businesses — is what’s attracting the investment here.

“We’re thrilled to reinvest in DataRails and continue working with the team to help them navigate their recent explosive and rapid growth,” said Yanai Oron, General Partner at Vertex Ventures, in a statement. “With innovative yet accessible technology and a tremendous untapped market opportunity, DataRails is primed to scale and become the leading FP&A solution for SMEs everywhere.”

“Businesses are constantly about to start, in the midst of, or have just finished a round of financial reporting—it’s a never-ending cycle,” added Oren Zeev, founding partner at Zeev Ventures. “But with DataRails, FP&A can be simple, streamlined, and effective, and that’s a vision we’ll back again and again.”

source https://techcrunch.com/2021/06/21/datarails-books-25m-more-to-build-better-financial-reporting-tools-for-smbs/

No comments:

Post a Comment